Contents Table

Introduction

Pilates Physical Health Benefits: FSA Eligibility

Maximising FSA: Pilates Qualifies

Preventive Health: Pilates FSA Coverage

Q&A

Conclusion

"FSA-eligible Pilates classes strengthen your body and wallet."

Introduction

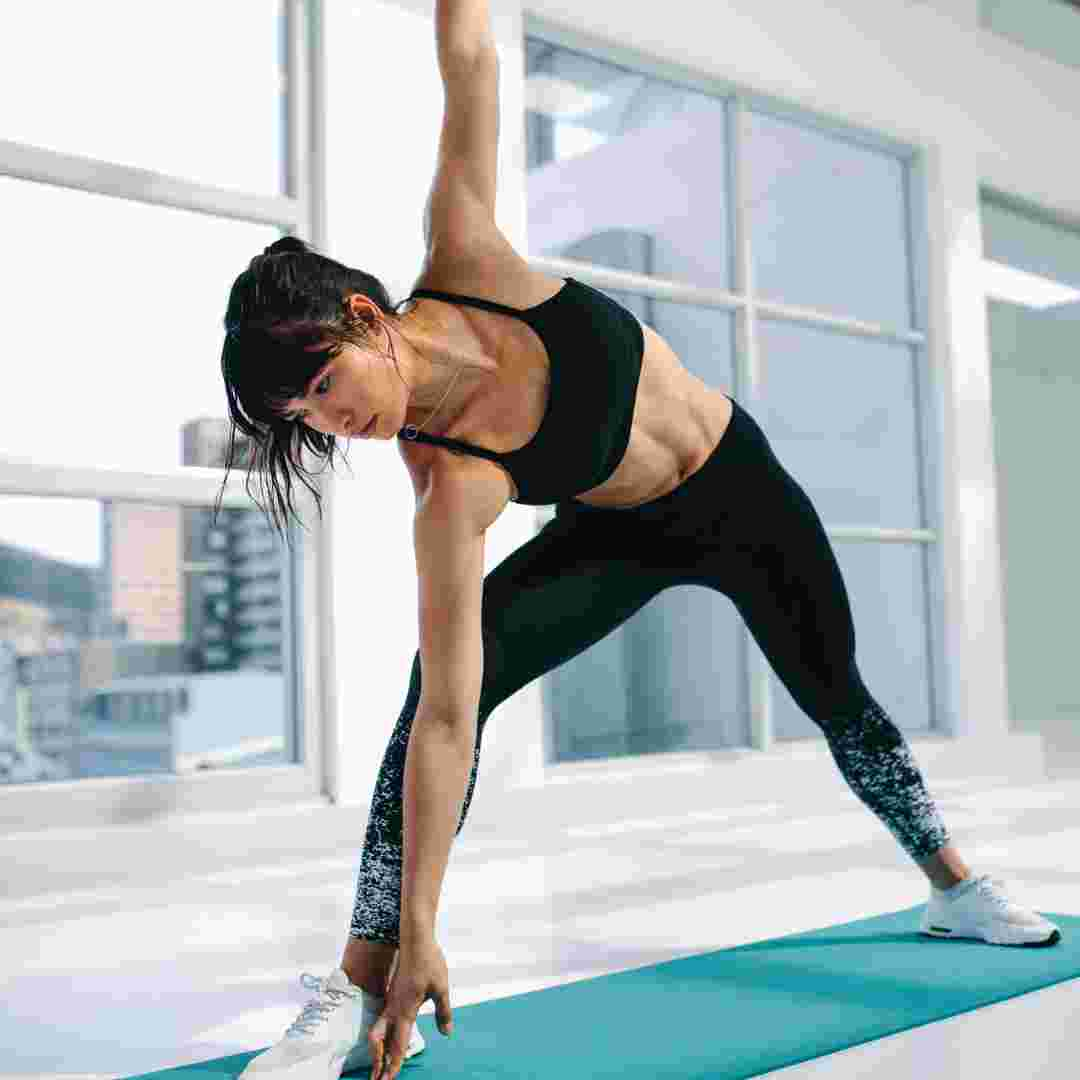

Pilates strengthens core muscles, improves flexibility, and improves posture. Many worry if their Flexible Spending Account covers Pilates.

Pilates Physical Health Benefits: FSA Eligibility

Pilates is a growing exercise trend. A low-impact workout, it strengthens core muscles, improves flexibility, and boosts fitness. Many ask if Pilates is FSA-eligible. It is. Pilates' physical health advantages and FSA eligibility will be discussed in this post.

Fitness can be improved with Pilates. It is low-impact and easy on the joints, making it suitable for all ages and fitness levels. Pilates strengthens core muscles for posture, balance, and stability. Improved flexibility reduces injury risk and boosts physical performance.

Back discomfort can be reduced by Pilates. Poor posture, weak core muscles, and sedentary lifestyles cause back discomfort in many people. Pilates strengthens core muscles, improves posture, and reduces back discomfort. By increasing flexibility and lowering muscle tension, it can reduce back discomfort.

Pilates also improves balance and stability. Balance and stability might diminish with ageing, increasing the risk of falls and accidents. Pilates strengthens core muscles and posture, enhancing balance and stability. This reduces falls and injuries, especially in older persons.

Pilates boosts physical performance too. It can boost flexibility, strength, and endurance, improving athletic performance and injury prevention. Professional athletes use Pilates to increase performance and reduce injury risk.

After discussing Pilates' physical health benefits, let's discuss its FSA eligibility. Flexible Spending Accounts (FSAs) are tax-advantaged accounts for medical expenses. Pilates prescribed by a doctor is a qualified medical expense.

If your doctor prescribes Pilates for back discomfort, you can use FSA funds to buy lessons or equipment. Pilates for general fitness or wellness may not be FSA-eligible.

Finally, Pilates is FSA-eligible if prescribed by a doctor to treat a medical condition and improves physical health. Pilates can reduce back discomfort, improve balance, and boost performance. Make sure your healthcare provider and FSA administrator approve Pilates as a treatment for your medical condition.

Maximising FSA: Pilates Qualifies

Employees often save on healthcare via Flexible Spending Accounts (FSAs). FSAs let workers save pre-tax cash for doctor visits, prescriptions, and medical equipment. Many people are unaware that FSA reimbursement is available for Pilates and other exercise activities.

Pilates is low-impact and strengthens core muscles, improves flexibility, and raises body awareness. It may be done at gyms, studios, or at home and is popular with all ages and fitness levels.

Pilates FSA-eligible? Yes, but with conditions. A doctor must recommend Pilates for a specific medical issue for FSA reimbursement. Pilates cannot be compensated through an FSA as a general fitness activity.

Pilates helps alleviate back pain, arthritis, and post-surgical rehabilitation, therefore you may be eligible to utilise FSA funds to pay for courses. However, you must produce medical proof from your doctor stating that Pilates is necessary for your condition.

Pilates must be prescribed and performed by a competent healthcare professional to be eligible for FSA reimbursement. This requires a licenced physical therapist, chiropractor, or other healthcare professional to lead Pilates courses or sessions as a medical treatment.

Note that not all Pilates classes or sessions are FSA-reimbursable. Pilates must be designed to treat a medical problem and taught by a trained healthcare provider to be eligible. FSA reimbursement is not available for Pilates or general fitness classes.

It's crucial to investigate and consult with a qualified healthcare professional who can give Pilates as a medical treatment before spending FSA funds for Pilates. You should also ask your doctor if Pilates is right for you.

In conclusion, Pilates is FSA-eligible if recommended by a doctor and performed by a competent expert. It's crucial to investigate and consult with a qualified healthcare professional who can give Pilates as a medical treatment before spending FSA funds for Pilates. Utilising your FSA funds can save healthcare costs and enhance your health.

Preventive Health: Pilates FSA Coverage

Pilates is a growing exercise trend. This low-impact workout strengthens core muscles, improves flexibility, and raises body awareness. Many people use Pilates to prevent injuries and improve their health. A common inquiry is if Pilates is FSA-eligible.

A Flexible Spending Account (FSA) lets people save pre-tax cash for qualified medical expenses. These costs include doctor visits, prescriptions, and medical equipment. It can be challenging to know which health expenses are covered by FSAs.

The Pilates answer is complicated. Overall, Pilates is not a medical expense and is not FSA-eligible. FSAs may cover Pilates in some cases.

If your medical condition necessitates physical treatment, Pilates may be covered by the FSA. A doctor's prescription and medical necessity letter are needed to send to your FSA provider.

Pilates may also be covered by FSA funds if your workplace offers a wellness programme. Your FSA plan and employer's wellness programme may dictate this.

Pilates may be qualified for FSA coverage, but there may be spending limits. FSA plans have a maximum contribution limit and may cap or pre-authorize specific expenses.

Check with your FSA provider or employer's benefits department to see if Pilates is FSA-eligible. They can explain what expenses your plan covers and any restrictions.

Pilates is good exercise for overall health, even if it's not FSA-eligible. Regular Pilates can improve posture, stress, strength, and flexibility. Pilates can help you prevent health problems by including it into your exercise programme.

Pilates is rarely an FSA-eligible expense. When used in a physical therapy or employer-sponsored wellness programme, it may be covered. Before utilising FSA funds for Pilates, verify with your FSA provider or employer's benefits department to determine eligibility and limitations. Pilates promotes health and wellness regardless of FSA coverage.

Q&A

1. Pilates FSA-eligible?

Pilates is FSA-eligible if prescribed by a doctor for a medical condition.

2. Can my FSA cover Pilates classes?

The FSA can cover Pilates sessions prescribed by a doctor for a specific medical condition.

3. What documents do I need to submit to my FSA provider for Pilates reimbursement?

Your doctor must write a letter stating that Pilates is necessary for your condition. Pilates class receipts or invoices may be required.

Conclusion

Conclusion: If a doctor prescribes Pilates for a medical problem, the FSA may cover it. It cannot be reimbursed by the FSA for general fitness and wellness. Consult your FSA plan administrator for precise requirements.